Invest in S&P ETF

MARCH 23, 2017

Money in the safe VS. Money in the stocks market

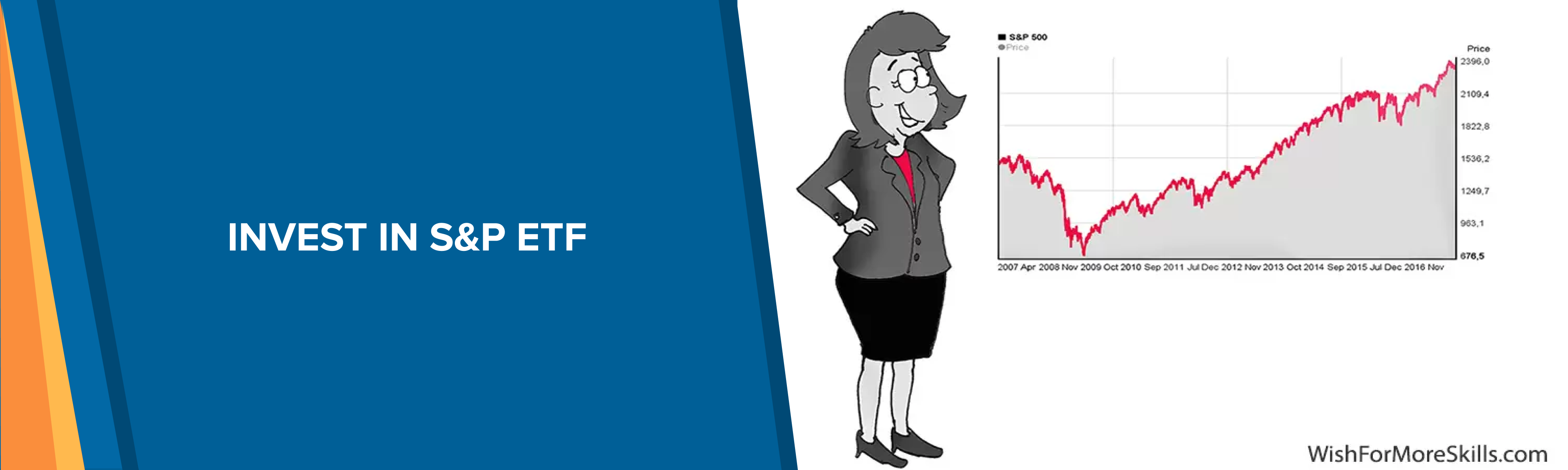

You have $1,000 tucked away and you are going to keep this just like it is in a safe for ten years. Now ten years from now that $1,000 is not going to have the same value because of the rise in inflation. So really you have lost a small percentage.

But, what would happen if you were to take that $1,000 and invest it? I can hear the gasp in your breath, but don’t panic. If you take the same $1,000 and invest them in the S&P (top 500 Companies in the USA) ETF you would have doubled your money.

** For this example I took the last 10 years (years 2007 – 2017) as an example as it includes the big 2008 crush. I want you to see that I am not trying to paint a nice picture. I want to paint a real picture that depicts the amount of in depth research I present.

Getting a Handle on the S&P ETF

This information you are about to receive is geared towards the “money hoarder”, or you may consider them to be a “money miser”, but there is a slight difference.

What is a ETF?

A ETF stands for exchange traded fund. The best mentors you can have when it comes to increasing your money are those who have been successful at it. It should be noted that many of these who have become wealthy investors have done so partly by investing in ETFs, and here is why….

Your are diversifying

You are choosing ETFs as one important part of your investment portfolio. In other words it is just one of several types of investments that you should be doing.

It is NOT Active Investing

Actually it is passive investing that you are participating in. There are cost savings with this type of investing. You achieve this by keeping the amount that you are buying or perhaps selling to a limited amount.

You Are Kept In The Loop

You can find out each and every day where your ETF is at, and what the current market price is. You can determine if your ETF is performing at a level that you are satisfied with.

Simple and Easy

You don’t have to be a whiz at this type of investment. You can simply buy or sell without having to be experienced with the stock market.

Its Cost Efficient to Buy

You don’t have to have tons of money to invest in ETFS and you may even find them cheaper to buy than mutual funds.

So there you have the reasons why savvy investors choose ETFs, now that’s the first step. The second step is choosing what would be considered to be the most lucrative ETFs and that takes you to the S&P 500. This is because there are strong factors to back it up. It happens to be the top 500 Companies in the USA and it makes up about 80% of the market cap for the entire nation.

You want to put a little thought here into which companies you are investing in. I personally go for strong companies like Microsoft, Johnson & Johnson, or ExxonMobile. I may get a smaller profit but I have the security in their stability. I am more conservative in this respect and shy away from the new trendy companies that may be offering a whopping 10 times more, but what happens if “there’s no more gold in them their hills.”

What it is going to come down to is whether you are going to take on the traits of an investor, or those of a gambler. Chances are if you have been a money hoarder that is now changing their ways, then you are going to be an investor.

Remember, that a money hoarder or a money miser is only living in the moment when it comes to their financial security. You, now as an investor are building your money pot for the future.